Stock Falls Amid Japanese and Technology Market Sell-Off

SoftBank has announced a $3.4 billion share buyback following a significant drop in its stock amid a broader sell-off in Japanese and technology shares. The technology investor’s stock has decreased by nearly a third over the past month due to concerns over high valuations of companies investing in artificial intelligence.

The slump reduced SoftBank’s market capitalization to $73.1 billion, significantly below its estimated $170 billion net asset value. This discrepancy led to the company’s shares trading at a discount of around 60 percent to the value of its holdings.

On Wednesday, SoftBank revealed a plan to repurchase up to 6.8 percent of its shares over the next 12 months. This announcement came after Elliott Management, an activist investor, called for a share buyback. Elliott Management is reported to have rebuilt a position in SoftBank worth more than $2 billion.

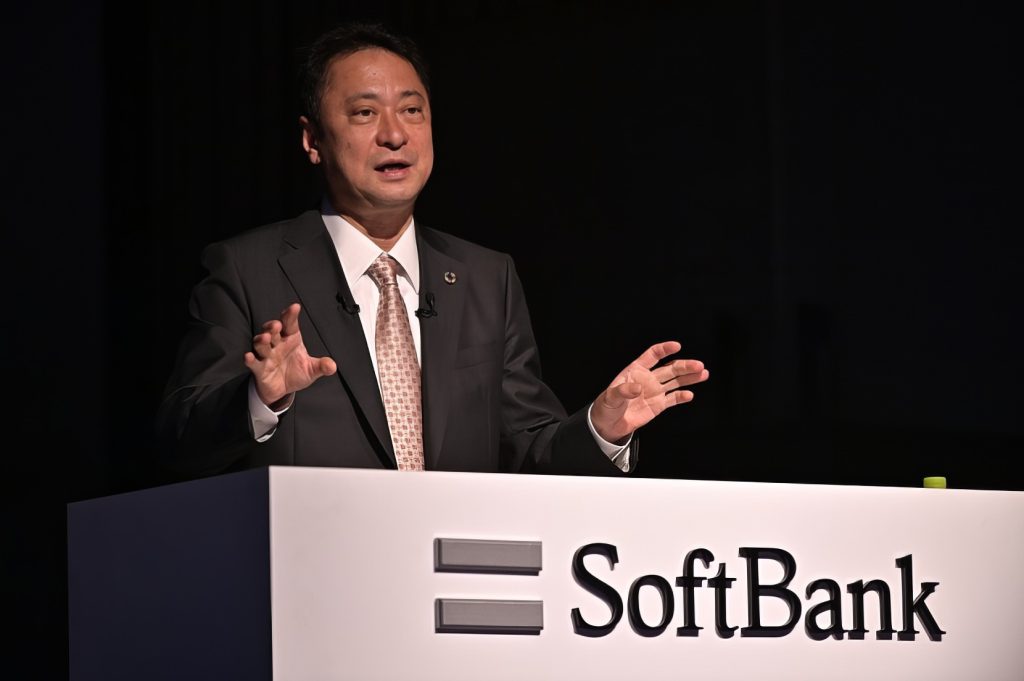

Yoshimitsu Goto, SoftBank’s chief financial officer, stated, “It’s certainly possible that we may decide on another share buyback programme at some point in the future. Shareholder return is always a main theme of discussion among the board of directors.” He emphasized that external pressure did not influence the decision, adding, “SoftBank is not the kind of company to make decisions based on the influence of an individual party.”

SoftBank is working to rebuild its finances after investments in loss-making companies, including a significant investment in WeWork, which filed for bankruptcy. The company is now focusing on the transformative potential of artificial intelligence, holding major stakes in businesses like Arm Holdings, the Cambridge-based chip designer.

The buyback announcement accompanied SoftBank’s financial results, which showed a surprising net loss for the three months ending in June. The first-quarter loss of 174.3 billion yen ($1.18 billion) was about a third of the loss recorded in the same period the previous year but was significantly worse than consensus estimates for a profit of 104.7 billion yen. These figures reflect a hit from higher taxes.

On a separate measure, net income, SoftBank posted a modest profit of 10.5 billion yen for the period. Its Vision Fund investment unit reported an investment gain of 1.9 billion yen, following an investment loss of 58 billion yen in the previous quarter.

Goto explained that SoftBank is investing with the advent of what it describes as an age of artificial superintelligence in mind. Recent acquisitions include British AI chipmaker Graphcore for an undisclosed sum. “The evaluation of new technology undergoes cycles of hype and correction, ultimately being assessed based on its actual performance,” the company stated.

SoftBank highlighted the use of generative AI across its portfolio, citing Klarna, the buy-now-pay-later company, using an AI assistant to handle customer queries, and ByteDance, the Chinese owner of TikTok, which has launched its own AI chatbot in China.

SoftBank’s shares rose $2.45, or 9.9 percent, to $27.16 on Wednesday morning in New York.