Bank of America is allocating $4 billion this year to advance new technologies, including improvements to its artificial intelligence tools for both clients and advisors, CEO Brian Moynihan announced on Tuesday. “AI has moved from cost savings ideas to enhancing the quality of our customer interactions,” Moynihan stated during a call with analysts. He highlighted the bank’s AI advisor and client insights tool, which has provided over six million insights to financial advisors so far this year.

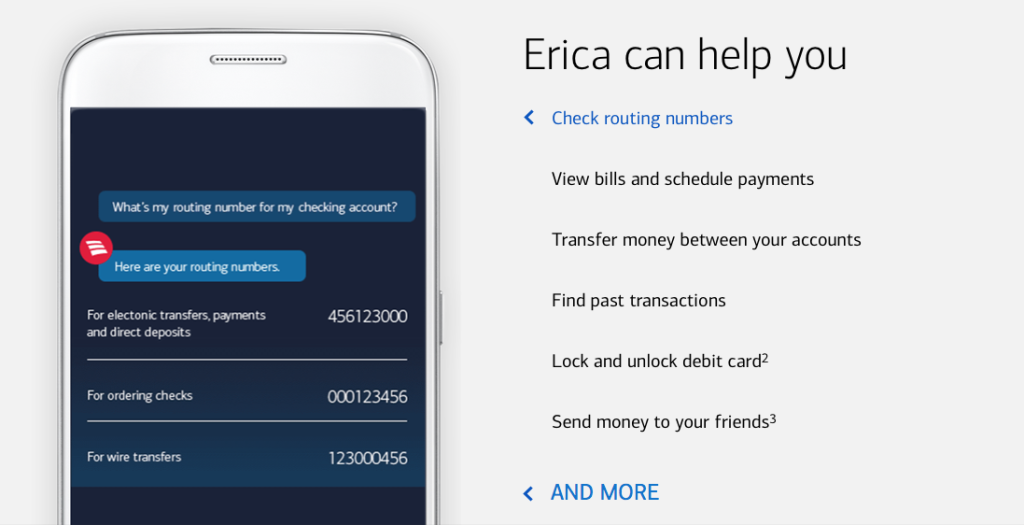

Major banks are heavily investing in AI, focusing on hiring talent, introducing AI-powered tools and assistants, and developing hundreds of new use cases across various business areas. Bank of America, the second-largest U.S. bank with $3.26 trillion in assets, dedicates $12 billion annually to technology, with a quarter of that amount earmarked for new technology initiatives in 2024. The bank’s virtual assistant, Erica, reached 2 billion interactions in April, with clients engaging with it approximately two million times per day.

Despite its advancements, Bank of America ranks 15th in the Evident AI Index, which measures the AI preparedness of the world’s largest banks, trailing behind competitors like JPMorgan Chase, Wells Fargo, Goldman Sachs, and Citigroup.

Bank of America exceeded Wall Street expectations in the second quarter, resulting in a rise in its stock price due to optimistic projections for the remainder of the year. Given its extensive consumer banking business, Bank of America is highly sensitive to net interest income (NII). The bank reported an NII of $13.7 billion, a 3% decrease from $13.83 billion in the second quarter of 2023. However, CFO Alastair Borthwick reassured investors that the second quarter represented an NII “trough.”

The bank increased its NII guidance to $14.5 billion for the year, anticipating higher levels for the remainder of 2024. Following the earnings report, Bank of America’s stock climbed 3.5% on Tuesday morning.

The firm reported $25.4 billion in revenue, a slight increase from $25.2 billion during the same quarter last year, surpassing analysts’ estimates of $25.22 billion according to FactSet. However, net income dropped nearly 7% to $6.9 billion from $7.4 billion a year earlier, though it still exceeded Wall Street’s projected $6.41 billion.