Businesses are rapidly adopting generative AI, but the challenge now lies in turning these significant investments into profits. This is the main insight from a new survey by consulting firm Bain & Company, which examined 200 US companies with revenues of at least $5 million. Half of these were tech companies, while the rest spanned sectors like retail, consumer goods, manufacturing, healthcare, and financial services.

Key findings from the survey include:

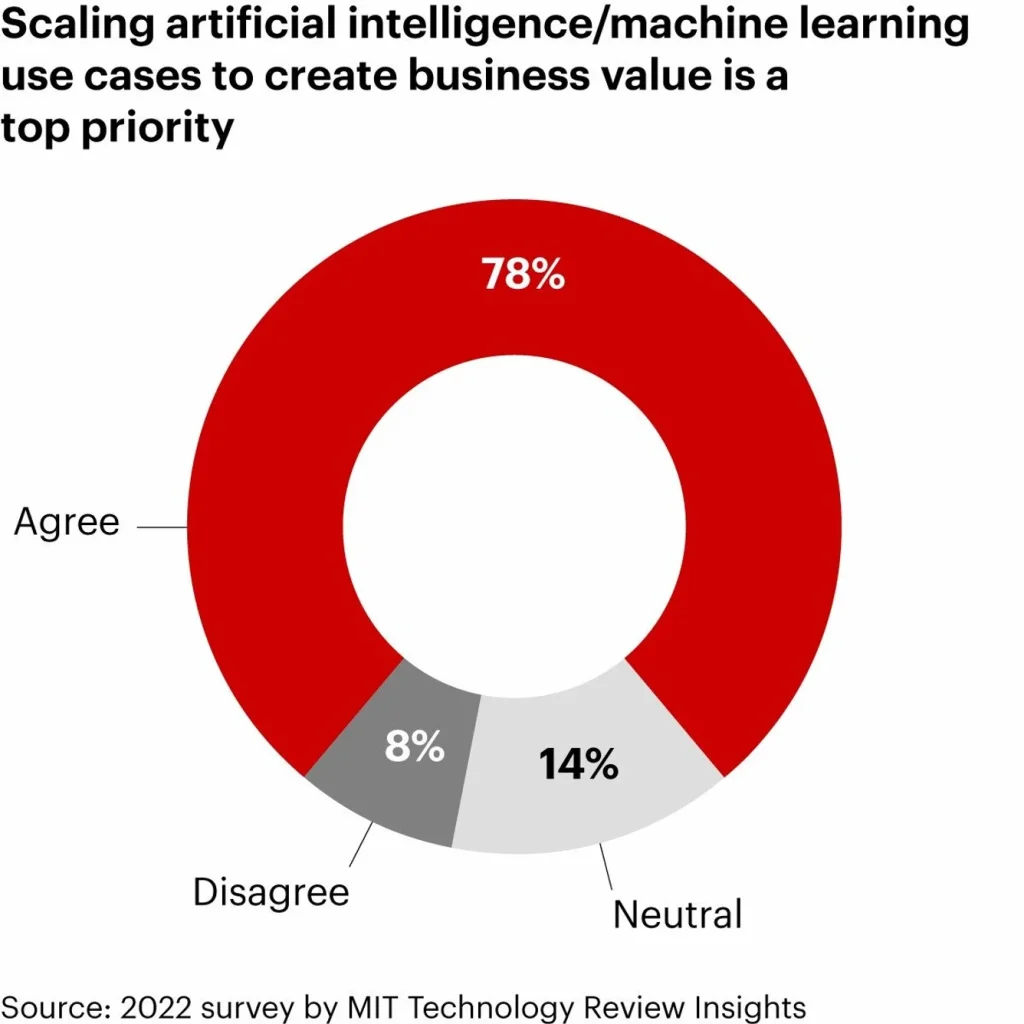

- 85% of companies consider adopting AI a top-five priority, with 12% ranking it as their top priority. Only 1% said it was not a priority.

- Language generation and software coding are the most common AI applications across various industries.

- On average, companies are spending $5 million annually on generative AI.

- 20% of the surveyed companies are spending over $50 million per year on generative AI.

- Companies with revenues exceeding $5 billion spend an average of $13.1 million annually, while those with $500 million or less spend about $1.6 million per year.

Despite high adoption rates, companies are still grappling with the question of return on investment. While many companies reported that generative AI met or exceeded expectations, the business case for substantial AI investments remains unclear. This uncertainty is a pressing issue for tech giants like Nvidia, Microsoft, OpenAI, and Google, who are heavily investing in AI’s future but need their customers to see tangible value in these new services.

Interestingly, only 11% of businesses surveyed by Bain had a clear vision for utilizing generative AI and understanding its value addition. This lack of clarity could stem from issues related to vision, talent, or the tools themselves. While most respondents were satisfied with the AI technology, a notable minority found the tools underwhelming.

The Bain survey also highlighted top concerns hindering faster adoption of generative AI. These include worries about the quality of AI outputs, data privacy, and security issues. Additionally, there is a growing concern over the lack of internal expertise. Compared to last year’s survey, expertise has become a more significant worry, while performance and security concerns have lessened.

Gene Rapoport, leading Generative AI initiatives for Bain’s Private Equity practice, emphasized the need for CEOs to take more ownership of AI tool implementation. This is crucial as most companies expect generative AI to boost revenue and improve productivity and efficiency, but few fully understand how this will happen.

Those developing AI tools are more optimistic. Oren Etzioni, an AI investor and professor emeritus at the University of Washington, noted, “There’s a natural cycle where you invest in new technology and then you expect pay-off. I’m very optimistic about the ROI coming.” He highlighted two ways ROI can improve: through observable revenue contributions and cost reductions. “As a field, computer scientists are so good at driving costs down. Even in the 19 months since it started, the cost per query has been documented to go down significantly and training is getting more efficient,” he added.

Nvidia CEO Jensen Huang echoed this sentiment in his Computex keynote speech, warning against “computation inflation,” where computing costs outpace AI model performance improvements. “This of course cannot continue,” he stated.